Understanding how to effectively evaluate a business model is crucial for entrepreneurial success. A robust business model isn’t just a concept; it’s the engine driving growth, profitability, and long-term sustainability. This guide provides a comprehensive framework for dissecting a business model, analyzing its strengths and weaknesses, and ultimately determining its potential for success. We will explore key aspects, from market analysis and financial projections to operational efficiency and scalability.

By examining critical components like revenue streams, cost structures, and competitive landscapes, we aim to equip you with the tools to make informed decisions. Whether you’re launching a startup, seeking investment, or simply looking to optimize your existing operations, mastering business model evaluation is paramount.

Defining the Business Model

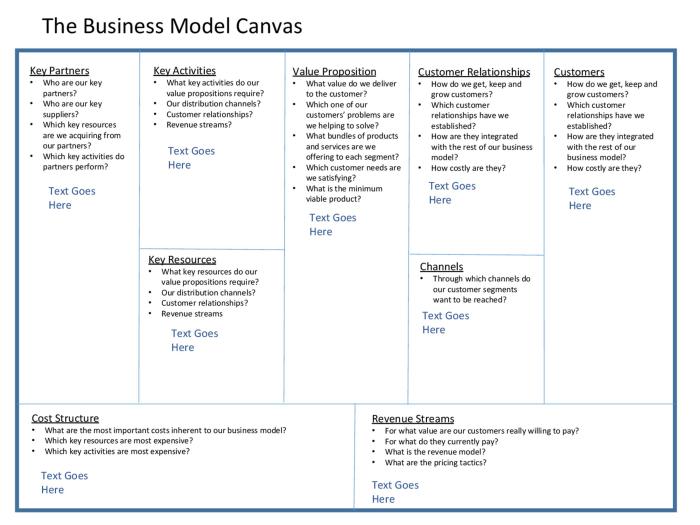

Understanding a business model is crucial for evaluating its viability and potential for success. A well-defined business model articulates how a company creates, delivers, and captures value. It’s a blueprint for how a business operates and generates revenue. A thorough analysis of a business model is essential before investing time, resources, or capital.A typical business model can be effectively represented using the Business Model Canvas, a strategic management and lean startup template for developing new or documenting existing business models.

Core Components of the Business Model Canvas

The Business Model Canvas consists of nine interconnected building blocks that provide a comprehensive overview of a business’s strategy. These blocks include: Customer Segments, Value Propositions, Channels, Customer Relationships, Revenue Streams, Key Activities, Key Resources, Key Partnerships, and Cost Structure. Each block describes a specific aspect of the business, and their interaction illustrates the overall value creation and delivery process.

For instance, the Value Propositions block details the benefits offered to customers, while the Revenue Streams block Artikels how the business generates income. Understanding the interdependencies between these blocks is key to comprehending the entire business model.

Types of Business Models

Numerous business models exist, each with its own strengths and weaknesses. Some prominent examples include subscription models, freemium models, and franchise models.

Comparison of Business Models

Let’s compare three distinct business models: Subscription, Fremium, and Franchise.

| Business Model | Description | Suitability | Example |

|---|---|---|---|

| Subscription | Recurring revenue generated through regular payments for access to a product or service. | Software, streaming services, gym memberships. Works well for businesses offering ongoing value or access. | Netflix, Spotify |

| Freemium | Offers a basic product or service for free, with premium features available for a fee. | Software, mobile apps, games. Effective for attracting a large user base and monetizing a subset. | Dropbox, Candy Crush |

| Franchise | A business grants the right to use its brand, processes, and trademarks to independent operators in exchange for fees. | Restaurants, retail stores, hotels. Allows rapid expansion with lower initial investment for the franchisor. | McDonald’s, Subway |

The suitability of each model depends heavily on the industry, target market, and the nature of the product or service offered. For example, a subscription model is ideal for software companies offering ongoing updates and support, while a freemium model is well-suited for mobile app developers aiming for broad user adoption. Franchising, on the other hand, is a powerful growth strategy for businesses with a proven business model and brand recognition.

The choice of business model is a critical strategic decision that significantly impacts the long-term success of a company.

Assessing Scalability and Sustainability

A robust business model isn’t just about generating immediate profits; it needs to be scalable and sustainable in the long run. This involves understanding the limitations to growth and developing strategies to overcome them, ensuring the model can adapt and thrive in a changing market. This section will explore the key factors affecting scalability and sustainability, and Artikel practical strategies to mitigate potential risks.Factors Limiting Scalability often stem from operational bottlenecks, inadequate resources, or market saturation.

For example, a small bakery relying solely on the owner’s baking skills will struggle to scale beyond a certain point. Similarly, a rapidly growing tech startup might find its customer support infrastructure overwhelmed as its user base expands. Understanding these limitations is crucial for proactive planning.

Limitations to Scalability

A business model’s scalability is often hindered by factors relating to its operational capacity, resource availability, and market dynamics. Operational limitations might include a dependence on a small, highly skilled workforce that’s difficult to replicate, or reliance on a specific, limited-capacity production process. Resource constraints can involve difficulties securing funding, accessing raw materials, or recruiting and retaining talent.

Finally, market limitations include factors such as market saturation, strong competition, or regulatory hurdles. For example, a local artisan cheesemaker might struggle to scale nationally due to limitations in production capacity and distribution channels.

Strategies for Improving Scalability and Sustainability

Improving scalability requires a multifaceted approach. This includes automating processes to reduce reliance on manual labor, outsourcing non-core functions to specialized providers, and developing robust supply chains to ensure consistent resource availability. Investing in technology, such as cloud-based software and automated manufacturing equipment, can significantly enhance operational efficiency and capacity. Diversification of revenue streams and expansion into new markets can also reduce reliance on a single product or customer base, improving long-term sustainability.

For example, a coffee shop could increase its scalability by introducing online ordering and delivery, wholesale partnerships with local businesses, or expanding into catering services.

Addressing Potential Risks and Challenges

A comprehensive risk assessment is crucial for long-term sustainability. Potential risks include economic downturns, changes in consumer preferences, technological disruption, and increased competition. Strategies to mitigate these risks include building financial reserves, continuously innovating products and services, fostering strong customer relationships, and proactively adapting to changing market conditions. Developing contingency plans for various scenarios, such as a sudden drop in sales or a supply chain disruption, is essential.

For instance, a company heavily reliant on a single supplier should diversify its sourcing to mitigate the risk of supply chain disruptions. Regular market research and competitive analysis can help anticipate and adapt to changing market dynamics, ensuring the business model remains relevant and competitive.

The Role of Business Development, Ethics, and Coaching

A successful business model requires more than just a sound concept; it needs consistent nurturing and ethical implementation. Business development, ethical considerations, and business coaching play crucial interconnected roles in ensuring a business model not only survives but thrives. These elements work synergistically, fostering growth, mitigating risks, and maximizing the model’s long-term potential.Business development activities are the engine driving a business model’s growth and market penetration.

They involve strategic planning, market research, sales and marketing efforts, and partnerships that translate the core business model into tangible results. Without a robust business development strategy, even the most innovative business model can fail to gain traction.

Business Development’s Contribution to Business Model Success

Effective business development directly contributes to the success of a business model in several key ways. It ensures the model reaches its target market effectively, identifies and capitalizes on new opportunities, and adapts to evolving market dynamics. For example, a company with a revolutionary new software-as-a-service (SaaS) model might employ business development strategies such as strategic partnerships with complementary businesses, targeted digital marketing campaigns, and the development of a strong sales team to acquire and retain customers.

These activities ensure the SaaS model’s value proposition reaches the right audience, leading to increased user adoption and revenue generation. Without these proactive measures, the innovative SaaS model might remain unknown or underutilized, hindering its potential.

Ethical Considerations in Business Model Implementation and Scaling

Ethical considerations are paramount throughout the entire lifecycle of a business model, from conception to scaling. Ignoring ethical implications can lead to reputational damage, legal repercussions, and ultimately, business failure. Ethical dilemmas can arise in various aspects, including data privacy, fair competition, environmental sustainability, and labor practices.

Examples of Ethical Dilemmas and Their Solutions

Consider a company using a freemium business model that collects user data. An ethical dilemma arises when deciding how much data to collect and how to use it. A solution might involve implementing strict data privacy policies, being transparent with users about data collection practices, and obtaining explicit consent before using data for purposes beyond the core service.

Another example is a company scaling its operations rapidly, potentially leading to exploitative labor practices. A solution here would be to prioritize fair wages, safe working conditions, and ethical sourcing of materials, even if it means slightly higher production costs. These examples highlight the importance of proactively addressing ethical concerns to build a sustainable and reputable business.

The Role of Business Coaching in Enhancing Business Model Effectiveness

Business coaching provides a crucial external perspective and guidance to improve the effectiveness of a business model. A business coach can help entrepreneurs and business leaders identify blind spots, refine strategies, and overcome challenges. Coaching often focuses on leadership development, strategic planning, and operational efficiency, all of which are vital for optimizing a business model’s performance. For instance, a coach might help a business leader struggling with delegation to develop better management skills, leading to increased team productivity and improved overall business model efficiency.

Similarly, a coach can facilitate the development of a more robust risk management strategy, mitigating potential threats and ensuring the long-term viability of the business model.

Funding and Financial Strategies

Securing adequate funding is crucial for the successful implementation and growth of any business model. A well-defined financial strategy, incorporating various funding options, is essential for navigating the challenges and opportunities inherent in business expansion. This section explores the role of business loans in supporting business model growth, compares different loan types, and presents a hypothetical financial plan illustrating their strategic integration.Business loans provide a vital injection of capital that can be leveraged to fuel various aspects of a business model’s development.

This can include purchasing equipment, expanding operations, hiring personnel, or managing working capital needs during periods of high growth. Access to capital through loans allows businesses to seize market opportunities and scale their operations more effectively than relying solely on internal funding or equity investments. The strategic use of loans allows businesses to accelerate their growth trajectory and achieve their long-term objectives more efficiently.

Types of Business Loans and Their Suitability

Different business models have unique financial needs and risk profiles. Therefore, the suitability of a particular loan type depends heavily on factors such as the business’s age, credit history, industry, and projected revenue streams. Matching the right loan to the business model is critical for ensuring financial stability and long-term success.

For instance, a startup with limited operating history might find it challenging to secure a loan based solely on its future projections. In contrast, an established business with a proven track record of profitability and strong cash flow may qualify for a wider range of financing options, including larger loans with favorable terms.

Secured vs. Unsecured Business Loans

Secured loans require collateral, such as real estate or equipment, to guarantee repayment. This reduces the lender’s risk, often resulting in lower interest rates and more favorable terms. Unsecured loans, on the other hand, do not require collateral but typically come with higher interest rates to compensate for the increased risk to the lender.

A bakery seeking to expand its operations might use a secured loan, pledging its existing ovens and commercial kitchen as collateral. This approach reduces the interest rate and offers a more manageable repayment schedule. A software company with strong intellectual property but limited physical assets might opt for an unsecured loan, accepting the higher interest rate in exchange for avoiding the risk of losing collateral.

Hypothetical Financial Plan Integrating Secured and Unsecured Loans

Let’s consider a hypothetical scenario: “GreenThumb Gardens,” a small organic farming business, plans to expand its operations by purchasing a new greenhouse and hiring additional staff.

| Funding Source | Amount | Purpose | Loan Type | Interest Rate (example) |

|---|---|---|---|---|

| Secured Loan | $50,000 | Greenhouse purchase | Term Loan (secured by land) | 5% |

| Unsecured Loan | $10,000 | Hiring additional staff | Line of Credit | 8% |

In this example, GreenThumb Gardens uses a secured loan to finance the significant capital expenditure of purchasing the greenhouse, leveraging its land as collateral to secure a lower interest rate. The smaller, unsecured loan is used to cover the operational expenses of hiring additional staff, acknowledging the higher interest rate associated with this type of loan. This balanced approach allows GreenThumb Gardens to manage its risk and effectively allocate its resources.

In conclusion, evaluating a business model requires a multifaceted approach encompassing market research, financial analysis, operational efficiency assessments, and a keen eye towards scalability and sustainability. By systematically analyzing these elements, entrepreneurs and investors can gain a clear understanding of a business’s potential for success and make informed decisions that mitigate risks and maximize opportunities. Remember, a well-evaluated business model is the foundation of a thriving enterprise.

FAQs

What is the difference between a business model and a business plan?

A business model describes how a company creates, delivers, and captures value. A business plan is a comprehensive document outlining the company’s goals, strategies, and financial projections.

How can I identify my target market effectively?

Conduct thorough market research using surveys, focus groups, and competitor analysis to define your ideal customer profile based on demographics, psychographics, and buying behavior.

What are some common pitfalls to avoid when evaluating a business model?

Common pitfalls include neglecting competitive analysis, overestimating market size, underestimating costs, and failing to account for potential risks and challenges.

How often should a business model be reevaluated?

Regular reevaluation is essential, ideally at least annually or whenever significant market changes or internal shifts occur. Adaptability is key.