Crafting a successful long-term business strategy is paramount for sustainable growth and enduring market presence. It’s not merely a document; it’s a roadmap, meticulously charting a course through evolving market landscapes, competitive pressures, and unforeseen challenges. This guide delves into the core components of a robust long-term strategy, exploring market analysis, resource allocation, operational efficiency, growth strategies, and risk management—essential elements for navigating the complexities of the business world and achieving lasting success.

From defining a compelling mission statement to developing adaptable contingency plans, we’ll examine practical strategies and proven techniques for building a resilient and thriving business. We’ll explore various growth models, emphasizing the importance of innovation and efficient resource management in driving sustainable expansion. The journey to long-term success requires careful planning, strategic execution, and a commitment to continuous improvement, all of which will be discussed in detail.

Defining Long-Term Business Strategy

A robust long-term business strategy is the roadmap guiding a company towards sustainable success. It’s more than just a set of goals; it’s a comprehensive plan outlining how a company will achieve its vision, considering both internal capabilities and external market dynamics. This plan anticipates challenges and opportunities, ensuring the organization remains competitive and relevant over an extended period, typically five years or more.

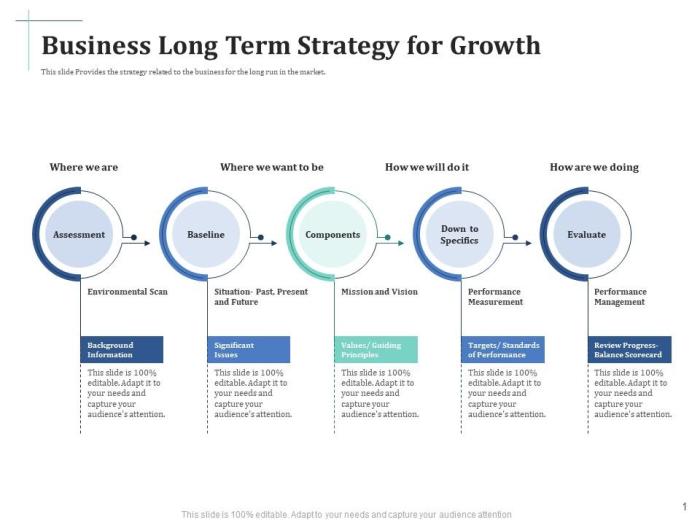

Core Components of a Robust Long-Term Business Strategy

A strong long-term business strategy incorporates several key elements. These components work in synergy to create a cohesive and effective plan for future growth and stability. A well-defined strategy considers market analysis, competitive landscape, internal resources, and financial projections to formulate a clear path forward. Without these core elements, a long-term strategy risks being ineffective or even irrelevant.

- Mission Statement: Clearly articulates the company’s purpose and overall goals.

- Vision Statement: Paints a picture of the company’s desired future state.

- SWOT Analysis: Identifies internal Strengths and Weaknesses, and external Opportunities and Threats.

- Target Market Definition: Specifies the ideal customer base and their needs.

- Competitive Analysis: Evaluates the competitive landscape and identifies key differentiators.

- Value Proposition: Defines the unique value offered to customers.

- Growth Strategies: Artikels plans for expansion, diversification, or market penetration.

- Financial Projections: Includes realistic financial forecasts and resource allocation plans.

- Key Performance Indicators (KPIs): Establishes measurable metrics to track progress and success.

Short-Term versus Long-Term Business Planning

The key difference lies in the timeframe and focus. Short-term planning typically covers a period of one year or less, concentrating on immediate operational goals and tactical execution. Long-term planning, conversely, encompasses a significantly longer timeframe (five years or more), focusing on strategic objectives and positioning the company for sustainable growth. Short-term plans are often operational, addressing day-to-day activities, while long-term plans are strategic, defining the overall direction and vision.

Short-term plans support the achievement of long-term goals.

The Importance of a Mission Statement in Shaping Long-Term Strategy

The mission statement serves as the foundation for the entire long-term strategy. It provides a clear sense of purpose and direction, guiding all decisions and actions. A well-crafted mission statement clarifies the company’s values, its target market, and its unique contribution to the industry. It acts as a compass, ensuring that all initiatives align with the overall strategic vision.

Without a strong mission statement, the long-term strategy risks becoming fragmented and unfocused. For example, a company with a mission to “provide sustainable and affordable energy solutions” will develop a very different long-term strategy than a company focused on “delivering cutting-edge technological innovations.”

Examples of Successful Long-Term Business Strategies

Several companies have demonstrated the power of effective long-term strategies. For example, Apple’s consistent focus on innovation and user experience has driven its long-term success in the technology sector. Their strategic investment in research and development, coupled with a strong brand identity, has resulted in sustained market leadership. Similarly, Procter & Gamble’s diversified portfolio of consumer goods brands, combined with a focus on global expansion and brand building, has ensured its long-term competitiveness.

In the fast-food industry, McDonald’s adaptation to changing consumer preferences (e.g., healthier options, delivery services) exemplifies a successful long-term strategic response to market shifts.

Market Analysis and Competitive Landscape

A robust long-term business strategy necessitates a thorough understanding of the market and its competitive dynamics. This involves analyzing prevailing trends, identifying potential threats and opportunities, and ultimately, positioning the business for sustained success. Failing to account for these external factors can lead to strategic miscalculations and missed opportunities. A comprehensive market analysis provides the foundation for informed decision-making and resource allocation.Understanding market trends and the competitive landscape is crucial for long-term strategic planning.

This involves identifying key market drivers, analyzing competitor actions, and assessing potential disruptions. By proactively anticipating changes in the market, businesses can adapt their strategies to maintain a competitive edge and capitalize on emerging opportunities.

Factors Influencing Market Trends

Several factors influence market trends, including technological advancements, economic conditions, regulatory changes, and shifting consumer preferences. For example, the rise of e-commerce has significantly altered the retail landscape, forcing traditional brick-and-mortar stores to adapt or face obsolescence. Similarly, increasing environmental concerns have driven demand for sustainable products and services, creating new market opportunities for eco-conscious businesses. Analyzing these macro and micro-environmental factors allows for a more accurate prediction of future market conditions.

Potential Threats and Opportunities in the Competitive Landscape

The competitive landscape is constantly evolving. Identifying potential threats and opportunities is vital for long-term success. Threats might include the emergence of new competitors, changes in consumer demand, or increased regulatory scrutiny. Opportunities, on the other hand, could involve the development of new technologies, expansion into untapped markets, or strategic partnerships. For instance, the rise of social media has presented both threats (increased competition for attention) and opportunities (new channels for marketing and customer engagement) for businesses across various sectors.

A well-defined strategy will address both.

SWOT Analysis

A SWOT analysis provides a structured framework for evaluating internal strengths and weaknesses against external opportunities and threats. Strengths might include a strong brand reputation, innovative products, or a highly skilled workforce. Weaknesses could include outdated technology, inefficient processes, or a lack of brand awareness. By identifying these internal factors and comparing them to external market dynamics, businesses can develop strategies that leverage their strengths, mitigate their weaknesses, capitalize on opportunities, and defend against threats.

For example, a company with a strong brand reputation (strength) might leverage that to expand into a new market (opportunity) while simultaneously investing in upgrading its technology (addressing a weakness).

Market Entry Strategies

Choosing the right market entry strategy is crucial for long-term success. Different strategies exist, each with its own advantages and disadvantages. These include organic growth, mergers and acquisitions, joint ventures, and franchising. Organic growth involves expanding gradually through internal resources, while mergers and acquisitions involve acquiring existing businesses. Joint ventures involve collaborating with another company, and franchising involves licensing a business model to others.

The optimal strategy will depend on various factors, including the company’s resources, risk tolerance, and market conditions. For example, a startup with limited resources might opt for organic growth, while a larger company seeking rapid expansion might pursue mergers and acquisitions.

Resource Allocation and Financial Planning

Effective resource allocation and robust financial planning are crucial for translating a long-term business strategy into tangible results. This section Artikels a strategic approach to resource management, funding acquisition, financial projection, and risk mitigation, ensuring the sustainable growth and profitability of the business.

Resource Allocation Plan

A well-defined resource allocation plan ensures that the most valuable assets – human capital, financial resources, and technological capabilities – are strategically deployed to achieve key strategic objectives. This plan should be dynamic, adapting to changing market conditions and internal capabilities. For example, a company launching a new product line might initially allocate a larger portion of its resources to marketing and sales, while a company focused on operational efficiency might prioritize investments in process improvement technologies.

The allocation should be based on a thorough assessment of each area’s contribution to overall strategic goals, considering factors such as return on investment (ROI) and potential risks. This detailed allocation process might involve using a weighted scoring system to prioritize projects and initiatives, ensuring alignment with the overall strategic objectives.

Funding Acquisition Methods

Securing sufficient funding is paramount for executing a long-term business strategy. Several methods can be employed, each with its own advantages and disadvantages. These might include seeking venture capital or angel investors for high-growth ventures, obtaining bank loans for established businesses with a proven track record, issuing bonds to raise capital from a wider investor base, or exploring government grants and subsidies for businesses in specific sectors.

For instance, a tech startup might seek venture capital to fund its research and development, while a manufacturing company might secure a bank loan to expand its production capacity. The selection of the most suitable funding method will depend on factors such as the company’s size, stage of development, and risk profile.

Financial Model Projection

A comprehensive financial model projects long-term revenue, expenses, and profitability. This model should incorporate realistic assumptions about market growth, pricing strategies, and operational efficiency. For instance, a five-year projection might include estimates of annual sales growth, cost of goods sold, operating expenses, and capital expenditures. The model should also account for potential variations in key assumptions, providing sensitivity analysis to illustrate the impact of changes in market conditions or internal factors.

A robust financial model serves as a valuable tool for monitoring progress, identifying potential challenges, and making informed decisions about resource allocation and investment. A common approach involves using discounted cash flow (DCF) analysis to determine the net present value (NPV) of future cash flows, providing a clear picture of the long-term financial viability of the strategy.

Risk Mitigation Strategies

Financial setbacks are an inherent risk in any business venture. Developing effective risk mitigation strategies is crucial for ensuring the long-term success of the business. These strategies might include diversifying revenue streams to reduce dependence on a single product or market, building strong relationships with suppliers and customers to ensure a stable supply chain, and maintaining sufficient cash reserves to weather unexpected downturns.

For example, a company might hedge against currency fluctuations by using derivative instruments, or it might invest in insurance to protect against unforeseen events such as natural disasters or legal liabilities. Regular monitoring of key financial indicators and proactive adjustments to the business plan are essential for mitigating financial risks and maintaining the long-term viability of the strategy.

Scenario planning, where different potential future scenarios are modeled and analyzed, can also be a valuable tool in identifying and mitigating potential risks.

Operational Efficiency and Innovation

Improving operational efficiency and embracing innovation are crucial for long-term business success. A streamlined operation reduces costs, enhances productivity, and frees resources for strategic investments, ultimately bolstering profitability and competitiveness. Simultaneously, innovation drives growth by introducing new products, services, or processes that meet evolving market demands and create a competitive edge. The interplay between these two elements forms a powerful engine for sustainable growth.Operational efficiency and innovation are intrinsically linked; advancements in technology often underpin improvements in operational efficiency.

For example, the adoption of automation can streamline processes, reduce human error, and boost output. Conversely, increased efficiency can free up resources to fund research and development, thereby fueling innovation. This synergistic relationship should be a central focus of any long-term business strategy.

Strategies for Improving Operational Efficiency

Effective strategies for enhancing operational efficiency encompass a multifaceted approach, focusing on process optimization, technology integration, and resource management. These strategies should be tailored to the specific needs and context of the business.

- Process Mapping and Optimization: Analyzing existing workflows to identify bottlenecks and areas for improvement. This involves charting every step of a process to reveal inefficiencies and redundancies, leading to streamlined operations. For instance, a manufacturing company might map its assembly line to pinpoint delays and optimize the flow of materials.

- Automation of Repetitive Tasks: Implementing automation technologies to handle routine, high-volume tasks. This frees up human resources for more strategic and value-added activities. An example would be using robotic process automation (RPA) in customer service to handle frequently asked questions or basic order processing.

- Inventory Management Optimization: Utilizing advanced inventory management systems to minimize storage costs and reduce waste. Just-in-time inventory management, for example, can significantly reduce storage space and carrying costs while ensuring timely availability of materials.

Opportunities for Innovation and Technological Advancements

Innovation isn’t limited to groundbreaking inventions; it encompasses incremental improvements and the strategic adoption of existing technologies to gain a competitive advantage.

- Artificial Intelligence (AI): AI offers transformative potential across various business functions, from customer service chatbots to predictive analytics for inventory management and risk assessment. Companies like Netflix utilize AI for personalized content recommendations, dramatically improving user engagement.

- Big Data Analytics: Analyzing large datasets to extract valuable insights that can inform decision-making across all aspects of the business. Retailers, for instance, use big data analytics to understand customer behavior and optimize marketing campaigns.

- Cloud Computing: Migrating data and applications to the cloud offers scalability, cost-effectiveness, and enhanced data security. Many businesses are adopting cloud-based solutions to reduce IT infrastructure costs and improve access to data.

Implementing New Technologies and Processes

Successful technology implementation requires a well-defined plan, encompassing careful selection, thorough training, and ongoing monitoring.A phased rollout is often recommended, starting with a pilot program to test the new technology or process in a limited context before wider deployment. This allows for early identification and resolution of potential issues, minimizing disruption and maximizing the chances of a successful implementation.

For example, a company introducing a new CRM system might start by implementing it in a single department before expanding to the entire organization. Effective change management strategies are crucial to ensure employee buy-in and minimize resistance to change.

Measuring and Tracking Progress Towards Operational Excellence

Key Performance Indicators (KPIs) are essential for monitoring progress toward operational excellence. These metrics should be carefully selected to reflect the specific goals and objectives of the business.

| KPI | Description | Example |

|---|---|---|

| Order Fulfillment Time | Time taken to process and deliver an order | Reduced from 5 days to 3 days |

| Inventory Turnover Rate | Number of times inventory is sold and replaced in a given period | Increased from 4 to 6 times per year |

| Customer Satisfaction Score (CSAT) | Measure of customer satisfaction with products or services | Improved from 75% to 85% |

| Defect Rate | Percentage of defective products or services | Reduced from 5% to 2% |

Regular monitoring and analysis of these KPIs are vital to identify areas for improvement and ensure the effectiveness of implemented strategies. This data-driven approach allows for continuous improvement and adaptation to changing market conditions.

Growth and Expansion Strategies

Sustained growth is crucial for long-term business success. A well-defined growth strategy, encompassing both organic expansion and strategic acquisitions, is essential to navigate the complexities of a dynamic market and achieve ambitious goals. This section Artikels various growth strategies and provides a framework for implementing a comprehensive expansion plan.Growth strategies can be broadly categorized into market penetration, market development, and diversification.

Each approach requires a distinct set of tactics and resource allocation, demanding careful consideration of market conditions, competitive landscape, and internal capabilities. Successful execution relies on a thorough understanding of the target market and a robust plan for managing the associated risks.

Market Penetration Strategies

Market penetration involves increasing market share within existing markets with existing products or services. This strategy focuses on intensifying efforts to attract more customers from the current target market. This might involve aggressive marketing campaigns, enhanced customer service, or competitive pricing strategies. For example, a coffee shop could implement a loyalty program to encourage repeat business from existing customers, thereby increasing its market penetration.

Effective market penetration often relies on understanding customer behavior and preferences, leveraging data analytics to personalize marketing messages and enhance customer engagement.

Market Development Strategies

Market development focuses on expanding into new markets with existing products or services. This could involve targeting new demographic segments, geographic regions, or distribution channels. A successful market development strategy requires thorough market research to identify potential new markets and adapt the product or service offering to meet the specific needs and preferences of those markets. For example, a company that sells software to small businesses might expand into the enterprise market, requiring adjustments to its product and marketing strategies to appeal to larger organizations.

Careful consideration of cultural nuances and regulatory requirements is essential when expanding into new geographical regions.

Diversification Strategies

Diversification involves expanding into new markets with new products or services. This strategy can mitigate risk by reducing reliance on a single product or market. However, it also presents significant challenges, requiring significant investment and expertise in new areas. There are two main types of diversification: related and unrelated. Related diversification involves entering markets that share synergies with the existing business, while unrelated diversification involves entering markets that have little or no connection to the existing business.

For example, a company that manufactures athletic shoes might diversify into related areas such as sportswear or fitness equipment. Unrelated diversification, on the other hand, would involve venturing into a completely different industry, such as finance or technology. A thorough risk assessment is crucial before pursuing a diversification strategy.

Expanding into New Markets

Expanding into new markets requires a systematic approach. The initial step involves conducting thorough market research to assess market size, competition, and consumer preferences. This is followed by developing a market entry strategy, which could involve direct investment, joint ventures, franchising, or licensing. Once the market entry strategy is selected, a detailed implementation plan needs to be developed, outlining specific activities, timelines, and resource allocation.

Continuous monitoring and evaluation are critical to ensure the success of the expansion effort. For example, a company expanding into a new country might initially focus on a specific region within that country, gradually expanding its reach as it gains experience and market share.

Scaling the Business for Growth

Scaling a business requires a proactive approach to managing resources and operations. This involves investing in infrastructure, technology, and personnel to support increased production and sales. It also requires developing robust systems for managing inventory, logistics, and customer service. A crucial aspect of scaling is developing a flexible and scalable organizational structure that can adapt to changing demands.

For example, a company experiencing rapid growth might need to implement new software systems to manage its operations more efficiently, or it might need to hire additional staff to handle increased customer inquiries. Regular review and adjustment of scaling plans are necessary to accommodate unforeseen challenges and opportunities.

Timeline for Expansion

Creating a timeline for achieving key milestones is crucial for successful expansion. This involves setting realistic goals and deadlines for each stage of the expansion process. The timeline should be broken down into smaller, manageable tasks, with clear responsibilities assigned to individuals or teams. Regular progress reviews should be conducted to identify potential issues and adjust the timeline as needed.

For example, a company planning to open a new store might set milestones such as securing a location, completing construction, hiring staff, and launching a marketing campaign. Each milestone should have a specific deadline, allowing for effective monitoring and management of the expansion process. Contingency plans should be incorporated to address potential delays or unforeseen circumstances.

Business Development and Related Concepts

Business development plays a crucial role in translating a company’s long-term strategic objectives into tangible results. It encompasses a wide range of activities, from identifying new market opportunities and forging strategic partnerships to developing innovative products and services. A robust business development strategy ensures that a company remains competitive, adaptable, and ultimately successful in achieving its long-term goals.

The Role of Business Development in Achieving Long-Term Strategic Objectives

Business development acts as the bridge between strategic planning and execution. It’s not simply about sales; it involves proactive market research, identifying unmet customer needs, and developing solutions that align with the overall strategic direction. For instance, a company aiming for market leadership might employ business development to acquire smaller competitors or forge alliances that expand its market reach and technological capabilities.

Successful business development initiatives directly contribute to revenue growth, market share expansion, and enhanced brand reputation – all key components of a successful long-term strategy.

Ethical Considerations in Business Development and Expansion

Ethical considerations are paramount in business development. Maintaining transparency and integrity in all dealings with customers, partners, and stakeholders is crucial for building long-term trust and avoiding reputational damage. This includes adhering to fair competition practices, avoiding deceptive marketing tactics, and ensuring responsible environmental and social practices throughout the expansion process. For example, a company expanding into a new market should carefully consider the potential impact on local communities and ecosystems, implementing sustainable practices to minimize any negative consequences.

Ignoring ethical considerations can lead to significant legal and financial repercussions, undermining long-term success.

Effective Business Coaching Techniques for Strategic Planning

Effective business coaching plays a vital role in guiding strategic planning and execution. Techniques include goal setting and performance monitoring, leveraging strengths and addressing weaknesses, fostering collaboration and communication, and promoting continuous learning and adaptation. For example, a coach might use SWOT analysis to help a business identify its internal strengths and weaknesses and external opportunities and threats, informing strategic decisions.

Mentorship and regular feedback sessions are also crucial for providing support and guidance throughout the process.

Comparison of Different Types of Business Loans and Their Suitability for Long-Term Growth

Several types of business loans cater to different growth needs. Term loans offer fixed repayment schedules, suitable for predictable expenses like equipment purchases. Lines of credit provide flexible funding for fluctuating needs, useful for managing cash flow during periods of expansion. Small Business Administration (SBA) loans offer government-backed financing, often with favorable terms, ideal for startups and small businesses.

The choice depends on the company’s financial health, risk tolerance, and specific growth plans. A company planning a significant expansion might opt for a term loan for large capital expenditures, while a business with seasonal revenue fluctuations might benefit from a line of credit.

The Importance of a Sound Business Model in Supporting Long-Term Strategy

A robust business model forms the foundation for long-term strategic success. It defines how a company creates, delivers, and captures value. It encompasses aspects like revenue streams, cost structures, key resources, and key partnerships. A well-defined business model ensures that the company’s operations are aligned with its strategic goals and that resources are allocated effectively. For example, a subscription-based business model provides predictable recurring revenue, which is crucial for long-term financial stability and planning.

The Connection Between Business Travel and the Development of Long-Term Relationships

Business travel facilitates the development of strong, personal relationships with clients, partners, and stakeholders. Face-to-face interactions foster trust and understanding, which are crucial for building long-term collaborations. Direct communication and networking opportunities during business trips often lead to more fruitful partnerships and stronger business relationships. For example, attending industry conferences allows businesses to connect with potential clients and partners, leading to new collaborations and business opportunities.

Comparison of Business Strategies and Their Long-Term Implications

The following table compares different business strategies and their long-term implications:

| Business Strategy | Description | Advantages | Long-Term Implications |

|---|---|---|---|

| Cost Leadership | Offering products or services at the lowest price in the market. | High market share, strong cash flow. | Vulnerability to price wars, potential for lower profit margins. |

| Differentiation | Offering unique products or services that stand out from competitors. | Premium pricing, strong brand loyalty. | Higher production costs, potential for niche markets. |

| Focus | Concentrating on a specific niche market segment. | Strong customer relationships, specialized expertise. | Limited market reach, vulnerability to changes in the niche market. |

| Blue Ocean Strategy | Creating new market space and reducing competition. | High growth potential, first-mover advantage. | High risk, requires significant innovation and investment. |

Risk Management and Contingency Planning

A robust risk management and contingency planning framework is crucial for the successful execution of any long-term business strategy. Ignoring potential threats can lead to significant setbacks, financial losses, and even business failure. Proactive identification and mitigation of risks, coupled with well-defined contingency plans, are essential for navigating unforeseen challenges and ensuring the continued progress towards strategic goals.Proactive risk identification involves systematically analyzing the internal and external environments to pinpoint potential threats.

This involves considering factors such as economic downturns, changes in consumer preferences, technological disruptions, competitive pressures, regulatory changes, and natural disasters. A thorough risk assessment should quantify the likelihood and potential impact of each identified risk, allowing for prioritization of mitigation efforts.

Potential Risks and Their Impact

Identifying potential risks requires a multi-faceted approach. For example, a company launching a new product might face risks related to production delays, negative customer reviews, or intense competition. A company expanding into a new market might encounter risks associated with unfamiliar regulations, cultural differences, or logistical challenges. A thorough analysis will consider both high-impact, low-probability risks (like a major natural disaster) and low-impact, high-probability risks (like minor supply chain disruptions).

Understanding the potential impact of each risk allows for the development of appropriate mitigation strategies. A company launching a new drug, for instance, would need to meticulously plan for potential regulatory setbacks or adverse reactions, while a company reliant on a single supplier would need to diversify its supply chain.

Contingency Planning for Disruptions

Once potential risks have been identified and assessed, the next step is to develop comprehensive contingency plans. These plans should Artikel specific actions to be taken in the event of a particular risk materializing. For instance, a contingency plan for a supply chain disruption might involve identifying alternative suppliers, securing backup inventory, or negotiating flexible contracts with existing suppliers. A plan for a sudden drop in sales might involve implementing cost-cutting measures, launching a marketing campaign, or adjusting pricing strategies.

Each contingency plan should be clearly documented, regularly reviewed, and updated as needed. Regular drills and simulations can help ensure that teams are prepared to execute these plans effectively.

Monitoring and Evaluating Risk Mitigation

Effective risk management is not a one-time exercise. It requires ongoing monitoring and evaluation of the effectiveness of implemented mitigation strategies. Key performance indicators (KPIs) should be established to track the progress of risk mitigation efforts. Regular reporting and analysis of these KPIs will highlight areas where improvements are needed. For example, a company might track the number of supply chain disruptions, the time taken to resolve them, and the financial impact of each disruption.

This data can then be used to refine contingency plans and improve overall risk management practices. Furthermore, post-incident reviews, analyzing what worked well and what could be improved, are critical for continuous improvement.

Examples of Successful Crisis Management

Many companies have successfully navigated crises by implementing effective risk management and contingency plans. For example, during the 2011 Tohoku earthquake and tsunami, many Japanese companies were able to quickly recover due to their robust disaster preparedness plans. Similarly, companies that diversified their supply chains during the COVID-19 pandemic were better able to withstand disruptions to global trade.

These examples demonstrate the importance of proactive risk management and the value of well-defined contingency plans in ensuring business continuity during challenging times. Analyzing case studies of successful crisis management can provide valuable insights and best practices for developing effective strategies.

Monitoring, Evaluation, and Adaptation

Successfully implementing a long-term business strategy requires a robust system for monitoring progress, evaluating effectiveness, and adapting to changing circumstances. Continuous monitoring and evaluation provide crucial feedback, allowing for proactive adjustments to maximize the chances of achieving strategic goals. Without this iterative process, even the most well-designed strategy can fall short.A well-defined system for monitoring progress is critical for staying on track and identifying potential problems early.

This involves establishing clear Key Performance Indicators (KPIs) aligned with strategic goals. Regular data collection and analysis will then reveal whether the strategy is delivering the expected results. This data-driven approach facilitates informed decision-making, ensuring timely corrective actions are implemented.

Key Performance Indicator (KPI) Selection and Tracking

Selecting the right KPIs is paramount. These should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, a company aiming for market share growth might track its market share percentage quarterly, alongside metrics like brand awareness and customer satisfaction. Regular reporting on these KPIs, perhaps monthly or quarterly, allows for early detection of deviations from the planned trajectory.

Visual dashboards displaying key metrics can facilitate easy monitoring and identification of trends. This ensures that deviations from the target are identified promptly, enabling timely intervention.

Strategy Effectiveness Evaluation Methods

Evaluating strategy effectiveness involves a multifaceted approach. Benchmarking against competitors reveals relative performance and highlights areas for improvement. Analyzing customer feedback provides insights into market perception and satisfaction levels. Financial performance metrics, such as return on investment (ROI) and profit margins, provide a quantitative assessment of the strategy’s success in generating value. Qualitative data, such as employee surveys and market research reports, offers valuable contextual information complementing quantitative data.

A balanced scorecard approach, incorporating financial, customer, internal processes, and learning & growth perspectives, offers a comprehensive evaluation framework.

Adaptive Strategy Modification Based on Data and Market Changes

Adapting the long-term strategy is not a sign of failure but a demonstration of responsiveness and resilience. Regularly reviewing performance data, market trends, and competitive activity is crucial. This allows for identification of opportunities and threats that necessitate strategic adjustments. For example, a sudden shift in consumer preferences might require a product line redesign or a new marketing campaign.

Similarly, the emergence of a disruptive technology could necessitate a complete reassessment of the business model. The adaptation process should be iterative and data-driven, with clear communication to all stakeholders.

Examples of Successful Adaptations to Changing Market Conditions

Netflix’s shift from DVD rentals to streaming exemplifies successful adaptation. Recognizing changing consumer preferences and technological advancements, Netflix proactively transitioned to a subscription-based streaming service, maintaining its market leadership. Similarly, many businesses adapted during the COVID-19 pandemic by rapidly implementing e-commerce solutions and remote work strategies, ensuring business continuity and even experiencing unexpected growth. These examples highlight the importance of flexibility, responsiveness, and a data-driven approach to strategic adaptation.

Ultimately, a successful long-term business strategy is a dynamic, evolving document that adapts to changing market conditions and internal capabilities. It’s a testament to foresight, adaptability, and a deep understanding of the competitive landscape. By meticulously planning, consistently monitoring progress, and proactively addressing potential risks, businesses can significantly enhance their chances of achieving not just short-term gains, but sustained, long-term prosperity.

The journey requires dedication, but the rewards—a thriving, resilient enterprise—are well worth the effort.

Top FAQs

What is the difference between a vision statement and a mission statement in a long-term business strategy?

A vision statement describes the aspirational future state of the company, while a mission statement Artikels the company’s purpose and how it will achieve its vision.

How often should a long-term business strategy be reviewed and updated?

Ideally, a long-term strategy should be reviewed and updated at least annually, or more frequently if significant market changes or internal developments occur.

What are some common pitfalls to avoid when developing a long-term business strategy?

Common pitfalls include unrealistic goals, insufficient market research, inadequate resource allocation, and a lack of flexibility to adapt to changing circumstances.

How can I measure the success of my long-term business strategy?

Success can be measured by tracking key performance indicators (KPIs) aligned with strategic goals, such as revenue growth, market share, customer satisfaction, and profitability.